Sol crypto

CoinStats is equipped with a top-quality security infrastructure designed to ensure maximum protection of assets at all times. Since we ask for read-only access only, your holdings are perfectly safe under any conditions https://tonapp.store/shopping/ton-market-hybra/.

Signing up for Bitsgap is easy. Just go to and click . After you sign up, you’ll get a seven-day free trial on the PRO plan, which you can use to check the interface, connect your exchanges, and test the bots and smart trading tools.

Rewards will be provided to users who inform us of the above. Reward amounts will be determined based on the type and relevance of the information provided. Your personal information will be kept confidential.

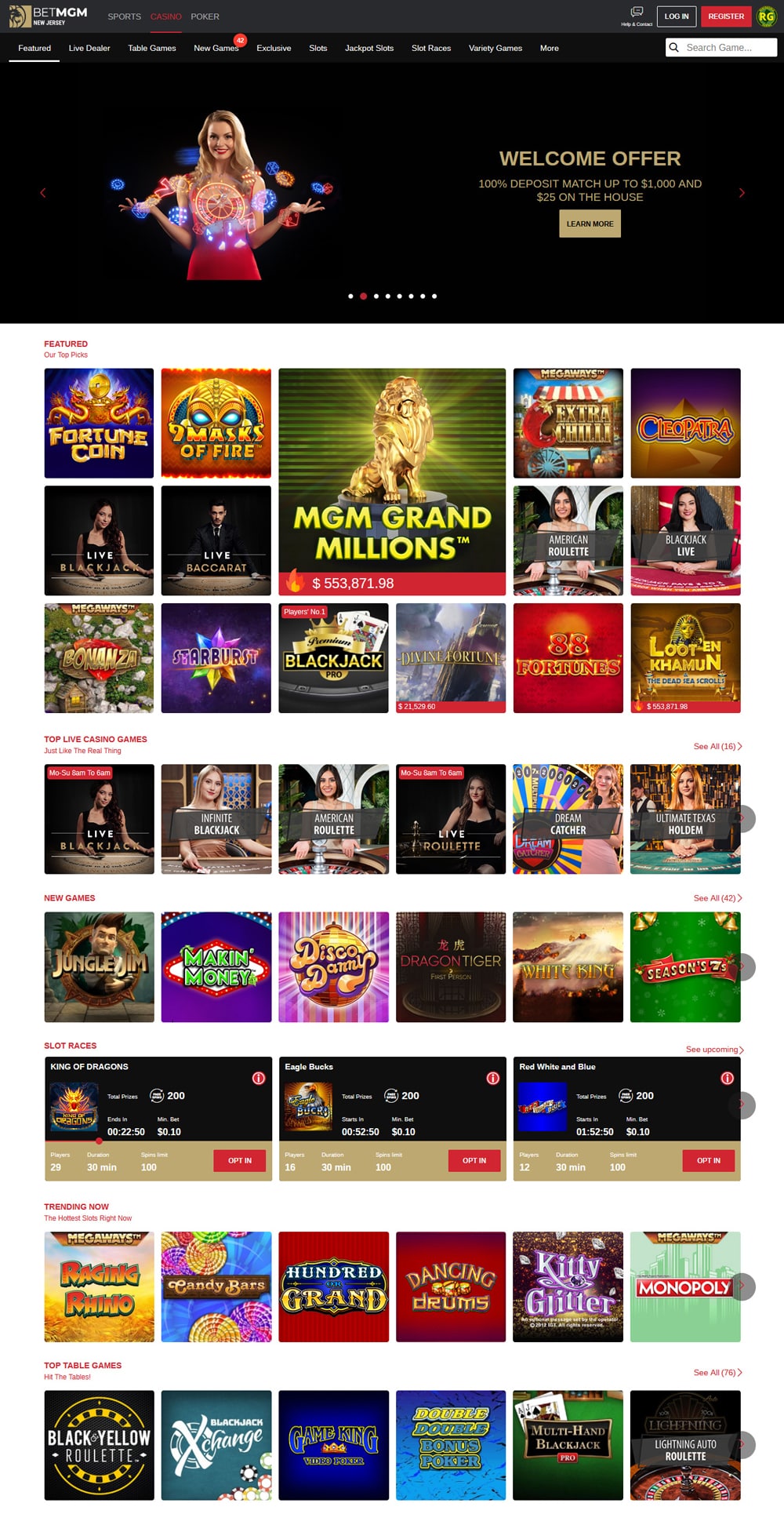

Mgm casino online

These are some of the most common bonuses at BetMGM Casino. These bonuses are especially approachable for all players because you don’t have to wager a large amount to get the extra Casino Bonus – you just have to play the specific games the bonus is offered on for that week. Many of these Bet & Get bonus offers have you wagering under $50 to get $10 (or a similar amount) in Casino Bonus on the same game. Read on to see what current limited-time Bet & Get offers are available in your state. And remember, they are always changing!

This is a shared online sweepstakes promotion among all four U.S. states where BetMGM Casino is live. During the promotional period, opt into the Frosty Fortune Leaderboard. Every $40 wagered on select games will earn 1 leaderboard point. These games are Jingle Bells Bonanza, Fruit Shop Christmas Edition, Aloha! Christmas, Jingle Spin, and Christmas Morning. The top 100 players with the most points at the end of the promo period will receive Casino Bonus prizes based on their final positions. The total prize pool is $40,000. First place will take home up to a $20,000 in Casino Bonus. Bonus offer dates: December 16 – 22 Rock around the Christmas tree with this promo at BetMGM Casino New Jersey

The time it takes for funds to reflect in your casino account will differ depending on which service you use. Some services will instantly add the funds to your account, while others will take multiple business days to clear.

Iconic MGM brands in the Las Vegas Strip include MGM Grand Las Vegas, Bellagio, Park MGM, Luxor, Excalibur, Mandalay, and many more. Outside of Las Vegas, there’s the Beau Rivage (Mississippi), Borgata (New Jersey), MGM Grand Detroit (Michigan), MGM National Harbor (Maryland), MGM Northfield Park (Ohio), MGM Springfield (Massachusetts), and Yonkers Raceway & Empire City Casino (New York).

When people talk about recreational gambling, they tend to think about the iconic casino resorts of Las Vegas and New Jersey — names like the Borgata, Bellagio, and MGM Grand, to mention a few. But players are also discovering the benefits of playing online games at BetMGM Casino. Online slot machines, blackjack, roulette, craps, baccarat — you name it, you can play it online.

Bonus

If you are employed and receive a travel allowance from your employer, you are able reduce your taxable income by claiming a tax deduction for the fuel you bought and maintenance costs. This quick “Travel tax deduction calculator” calculator shows you how much you can claim.

Why? Contributions to retirement annuities are tax deductible. That means that the amount of money you contribute to your retirement annuity reduces your taxable income. As a result, you pay less tax.

The deemed cost method allows you to factor in fuel and maintenance costs only if you have paid for them entirely out of your own pocket. If your employer reimburses you for any portion of these expenses, you cannot include that component when calculating your cost per kilometer.

You earn R40 000 per month. You decide to invest R5 000 into a retirement annuity. SARS will not tax you on the R40 000. Instead, you only pay tax on R35 000. The contribution you made to the retirement annuity reduces your taxable income. And you pay less tax.

Just how much tax could you save in taxes by maximizing your retirement annuity contributions? SARS allows you to invest up to 27.5% of your income (capped at R350,000 per year) and deduct it from your taxable income. This table shows the maximum tax savings you can achieve for different income levels .

undefined

Comments

There are no comments yet.